As a main aluminum producer, Alcoa (AA) announced cost-cutting measures, along with plans to curtail production at one Western Australian Refinery. But that is just one facility, and the company plans to continue to operate its port facilities located alongside the refinery. Plus, it will continue to import raw materials and export alumina produced at the Company’s Pinjarra Alumina Refinery.

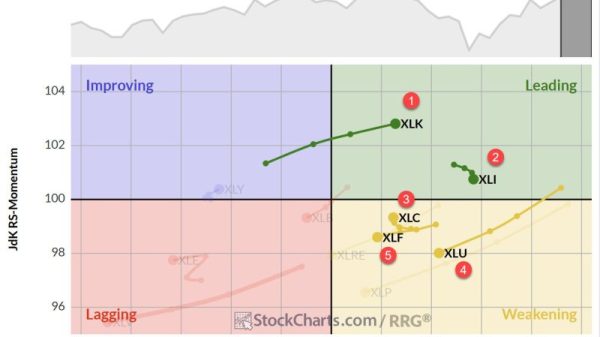

Alcoa Corporation is a Pittsburgh-based industrial corporation. It is the world’s eighth-largest producer of aluminum. Alcoa conducts operations in 10 countries. Russia is the 3rd largest producer of aluminum, India is number 2, and China is the world’s largest producer. I am interested in the metal mining space, as well as industrial metals as an area that could play catch up in 2024, especially with any supply chain disruption.

The daily chart of the company looks interesting. There is near-term support at 31.00 and major support at 30.00. And we really want to see the price regain 33.00. Our Leadership indicator shows it slightly outperforming the SPY. Real Motion has momentum improving, as it is back over the zero line. Plus, we cannot wait to see the January calendar ranges when they reset next week.

Aluminum futures have a bit of different look.

The futures chart shows us a dramatic decline in price from December’s peak. 2180 is the major support here. A move back over 2250 should send aluminum back up to test higher levels.

If this is a double top, then we will see the March contract fail 3280. However, it could also be a somewhat lopsided inverted head and shoulders with a neckline breakout over 2420. I would not necessarily wait for that to enter this trade. I would, however, add to a long position if it gets up there.

Bottom line, AA and the futures chart are great tools to use to assess the strength of the industrial metals, economic growth, supply and demand, and, quite possibly, a reignition of inflation.

This is for educational purposes only. Trading comes with risk.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Sales. Cell: 612-518-2482.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

The Money Show is having a speaker’s special promotion for all of my followers to receive a Standard Pass for the Las Vegas MoneyShow for ONLY $99!!!!

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth.

Grow your wealth today and plant your money tree!

“I grew my money tree and so can you!” – Mish Schneider

Follow Mish on X @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish covers oil, gold, natural gas, silver and sugar, plus teaches you how to use charts to determine short-term trading strategies in this video from CMC Markets.

Mish and Maggie Lake discuss inflation (given the wage component in the payroll report), Bitcoin (given the looming deadline for ETF news), the market outlook, small caps, and emerging markets on this video from Real Vision.

Mish covers war, energy, food and a pick of the day on Business First AM.

On the Tuesday, January 2 edition of StockCharts TV’s The Final Bar, Mish (starting at 22:21) talks small caps, retail, junk, and why all three matter in 2024 a lot.

In this appearance on BNN Bloomberg, Mish talks a particularly interesting chart, plus other places to invest in 2024.

In this appearance on Fox Business’ Making Money with Charles Payne, Mish talks with Cheryl Casone about Bitcoin’s volatility and why EVs may not be such a great place to invest in right now.

Recorded on December 28, Mish talks about themes for 2024 to look for, and tells you where to focus, what to buy, and what to avoid depending on economic and market conditions on Singapore Breakfast Bites.

Mish sits down with 2 other market experts to help you prepare for 2024 with predictions, picks, and technical analysis in StockCharts TV’s Charting Forward special.

Coming Up:

January 22: Your Daily Five, StockCharts TV

January 24: Yahoo! Finance

Weekly: Business First AM, CMC Markets

ETF Summary

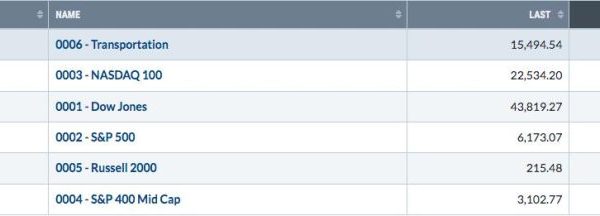

S&P 500 (SPY): 480 all-time highs, 460 underlying support.Russell 2000 (IWM): 195 pivotal, 180 major support.Dow (DIA): Needs to hold 370.Nasdaq (QQQ): 390 major support with 408 resistance.Regional banks (KRE): 50 support, 55 resistance.Semiconductors (SMH): 170 cleared with this sector back in the lead.Transportation (IYT): Needs to hold 250.Biotechnology (IBB): 135 pivotal support.Retail (XRT): 70 now key and pivotal.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education