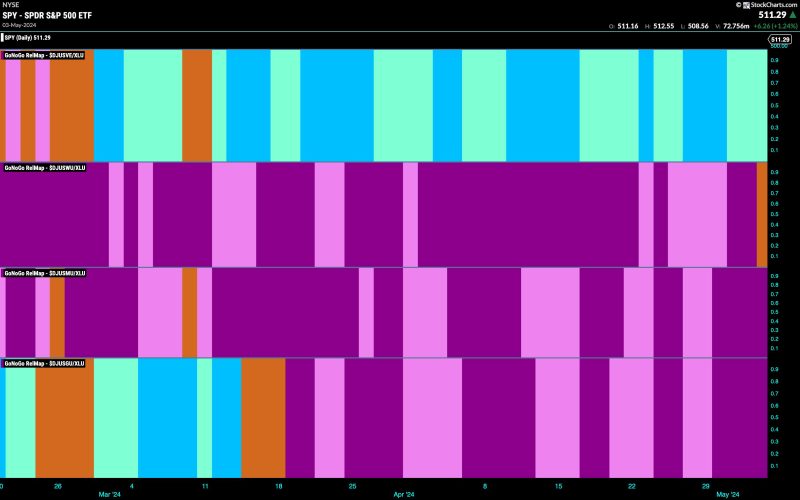

Good morning and welcome to this week’s Flight Path. The equity “NoGo” trend struggled this week as prices climbed from lows. We see an amber “Go Fish” bar as the market tries to understand the trend. GoNoGo Trend paints pink “NoGo” bars for treasury bond prices and commodity prices enter a period of uncertainty with consecutive amber “Go Fish” bars. The dollar, currently, is the only asset that is in a “Go” trend as we see the indicator painting weaker aqua bars. Lots of uncertainty this week!

Markets Uncertain of Equity Trend

The “NoGo” trend gave way to an amber “Go Fish” bar at the end of the trading week. We know, that when the amber bar is painted it is because there are not enough criteria being met behind the scenes for the GoNoGo Trend indicator to identify a trend in either direction, Go or NoGo. Adding to the feeling of uncertainty is the candle itself. A doji candle is when the open and close price are the same or very close, and this is what we saw on Friday. There was no clear winner between the bulls and the bears. No surprise then, when we look at the oscillator panel we see the GoNoGo Oscillator riding the zero line and a Max GoNoGo Squeeze in effect. This is a visual representation of the tug of war between buyers and sellers at this level. We will watch closely to see in which direction the Squeeze is broken, as this will help us determine price direction.

The larger weekly chart shows that we are at an inflection point here as well. We have seen a 4th consecutive weak aqua “Go” bar as price seems to have set a new higher low. GoNoGo Oscillator has crashed over the last month to test the zero line from above where we will watch to see if it finds support. If it does, we will see signs of trend continuation on the price chart. A break below the zero line would signal a more drawn out correction.

Rates Fall After Consolidation

This entire week saw GoNoGo Trend paint weaker aqua “Go” bars as price fell from its most recent high. We turn our eye to the oscillator panel and see that GoNoGo Oscillator has failed to find support at that level. As it dips its nose into negative territory we can say that momentum is out of step with the “Go” trend and we will watch to see if it sinks further into negative territory. If it does, then we may see trend change above. A rally back to the zero line would likely allow the “Go” trend to continue in the short term.